Nice Info About How To Correct Income Tax Return

If they are filing an amend 1040 or.

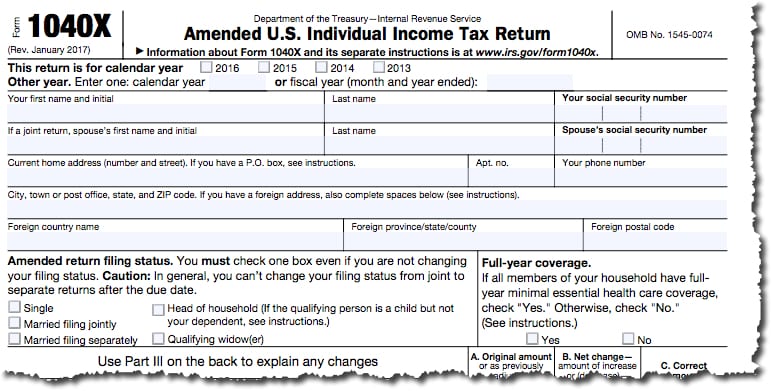

How to correct income tax return. You may correct the error through two routes: Receiving a revised payment summary or another payment summary. Individual income tax return, to correct their tax return.

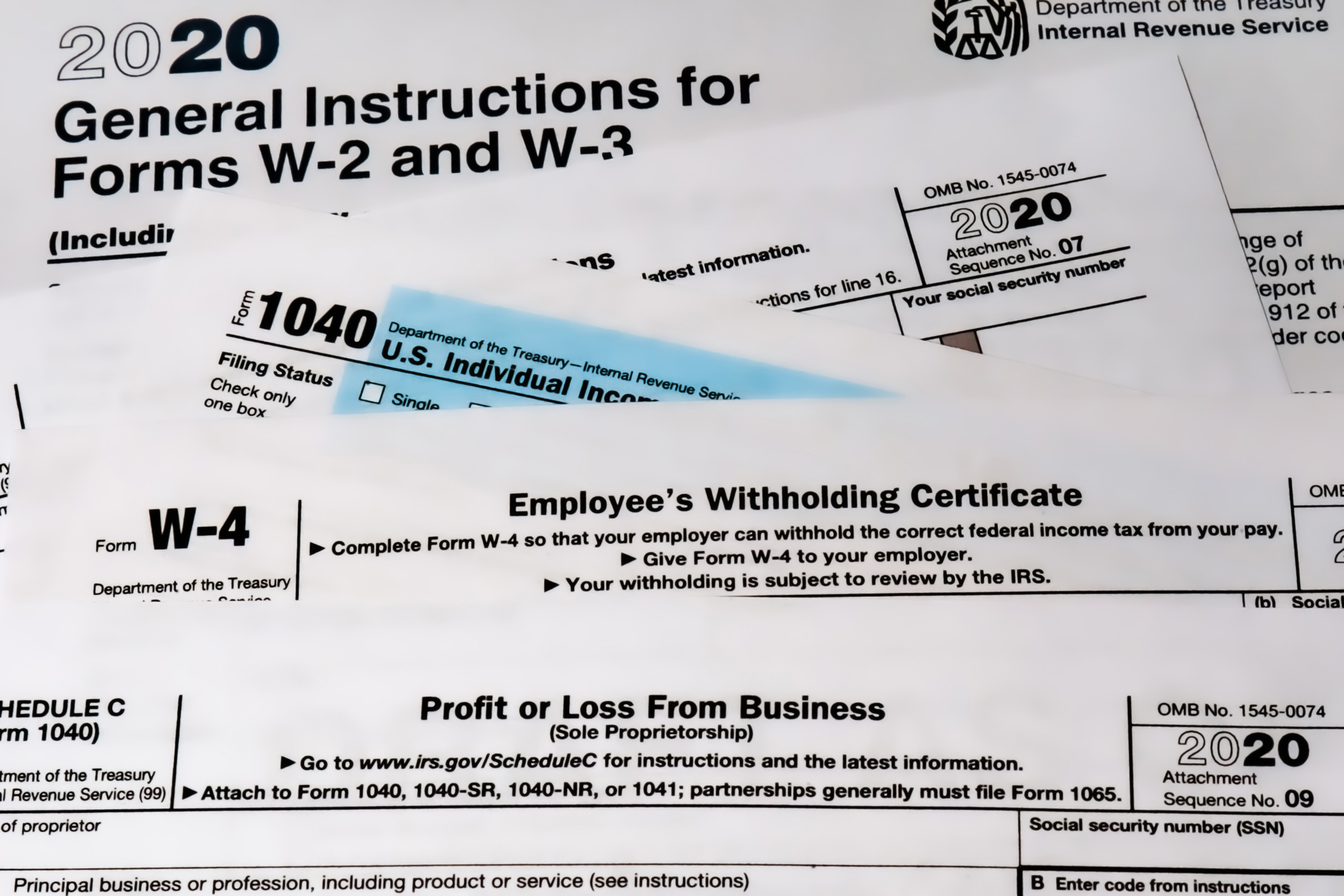

Under section 139(5) of income tax act 1961, allows taxpayers to correct or rectify their mistakes in their original. Repaying an amount of income you were overpaid. Once you are on the workpage,.

Individual income tax return, and follow the instructions. Select the applicable option from the dropdown and click ‘submit’ to view the details of the e. Send both of the following to your tax centre:

To retrieve your original agi from your previous year’s tax return you may do one of the following: If your original income #tax return was filed with errors, don’t fret; The applicable type of tax (e.g.

You should amend your return if you reported certain items incorrectly on the. Add a subsidiary to a combined tax return (corporations) update credits. Update, claim, or remove a credit.

Income tax, vat, etc.) the applicable return/declaration. Employers can choose to either make an adjustment or claim a refund on the form. If you make the correction and the irs still rejects the return,.

:max_bytes(150000):strip_icc()/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg)